The local, and for now also macro, bottom for LINK against Bitcoin came back in June, roughly four months ago. As of the time of writing, the price is pulsating about 74% higher from that point.

Chainlink previously rallied against Bitcoin from May '22 but peaked around November of that year before reversing course and making new lows. While the rally ultimately put up a % gain in the 120's, once it hit around its mid 70's the movement was much more horizontal from that point, and it chopped back and forth in a 25% range which may have been seen as lackluster for late entrants.

This begs the question, is the current rally fated for the same type of price action? While the answer is obviously 'maybe', we have a couple of reasons to believe this rally may have higher upside than the previous one(s).

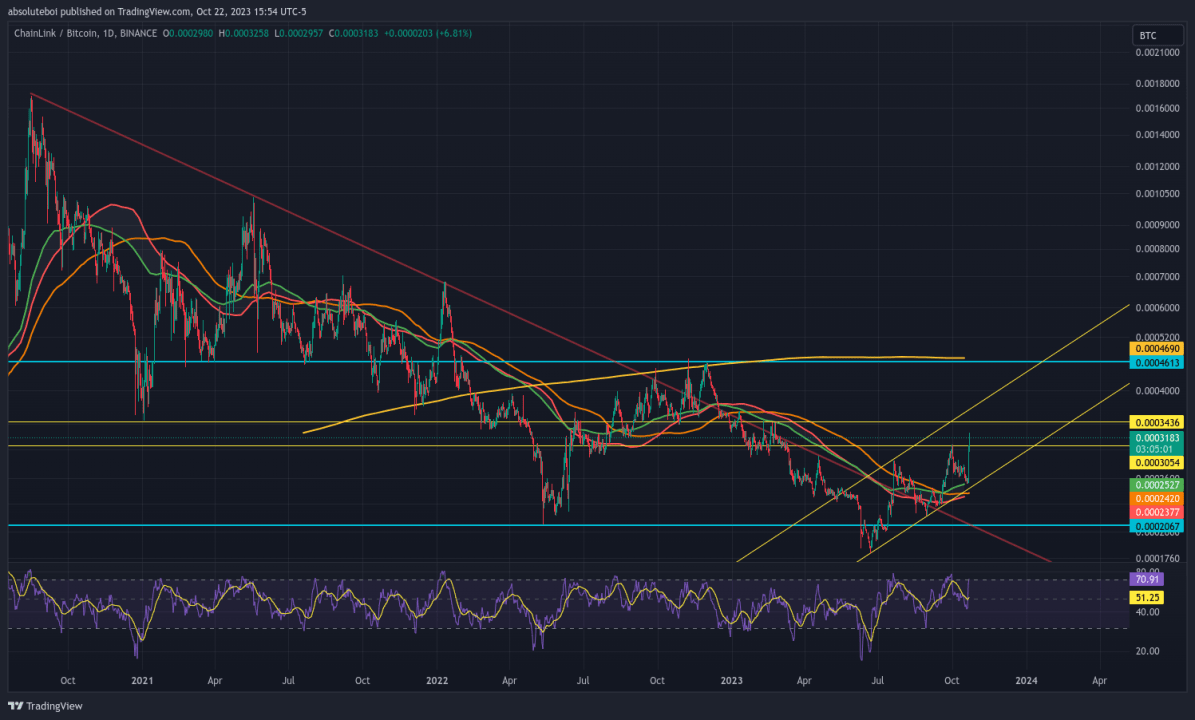

The first focal point is marked by the red line descending from the all time high, which was hit back in August of 2020. It hit its cycle peak against Bitcoin before most alts which saw their peaks come in the spring and fall of 2021, with some peaking as late as spring of 2022.

This means that Chainlink is further along into its winter phase than the altcoin market as a whole (we are treating this assumption as a given) so the likelihood of its local bottom holding should therefore be higher. The fact that many other alt/btc pairs are at or below range lows is telling in comparison to LINK.

This is one thing that makes the current rally different from the previous one in '22. That rally rallied into the ATH trendline and had lost significant strength when the time to test it finally came. That trendline has already been taken out. At this point resistance is mostly going to come at horizontal levels. The token still has a massive hole to dig its way out.

The second difference is that the price is lower, and has seemingly limited resistance below the previously rally's inflection point.

This is where the blue horizontals come into play. The top one, which is the one that warrants explanation, is based on the price action going back to late 2020/early 2021 to 2022 rally peak. In December of '20 the price broke below 0.00004613 and held below that for a few weeks until early 2021, at which point it broke out, retested, and rallied until eventually peaking and setting the second touch point of what would be the ATH descending trend line.

This price would come back into play in early Q3 of 2021, where it managed to break a downtrend before fizzling out and beginning its choppy price action beginning in late 2021. Finally, after spending a year below this price, made two touches before falling again.

There has been a lot of consolidation between these two prices over the last few years, so it's not a given that the top of the range will be tested imminently. But we are looking at the June bottom as a deviation/fakeout, and we've mentioned the power of fakeouts before. Per our trading playbook, this is a hold for now.